From dream to reality: Free class guides participants along the path to home ownership

Posted On: October 1, 2019

With rent prices going through the roof, more and more people are looking to get into home ownership. And many of them, particularly first-timers, need help – just the kind of help Volusia County can provide. They need help with understanding and navigating the complicated process and, for some, financial help to make their dream of home ownership affordable.

That probably explains why business is booming at a monthly homebuyer education class jointly sponsored by the county and the University of Florida. On average, the monthly class offered in DeLand through the University of Florida/Volusia County Extension had been drawing about 20 participants, according to the lead instructor, Family & Community Science Extension Agent Lisa Hamilton. But my, how things have changed. Now, there’s a waiting list to get into the class.

“It’s a complicated time to be buying a house,” Hamilton told the approximately 60 people who packed the classroom for the most recent session – about triple the usual attendance. “But you can do it. We’re here to help you make your dreams come true.”

Free of charge, the eight-hour class delivers a crash course in the ABCs of buying a home. It’s but one part of a broad range of services and resources the county makes available through its Community Assistance Division to help strengthen neighborhoods, combat homelessness and improve the quality of life for Volusia County residents in need of a helping hand. The programs – such as homebuyer assistance, emergency rental assistance, home rehabs, and construction and home ownership counseling – are designed to help expand the availability of affordable housing options in Volusia County. The county’s community assistance programs are largely funded by grants and include local partners such as housing agencies and nonprofit organizations.

“We work hard to help create housing opportunities for our residents,” said the county’s Community Services Director, Dona Butler. “For some, that means owning their own home. For others, renting is the way to go. But either way, we want everyone to have a roof over their head and a place to call home.”

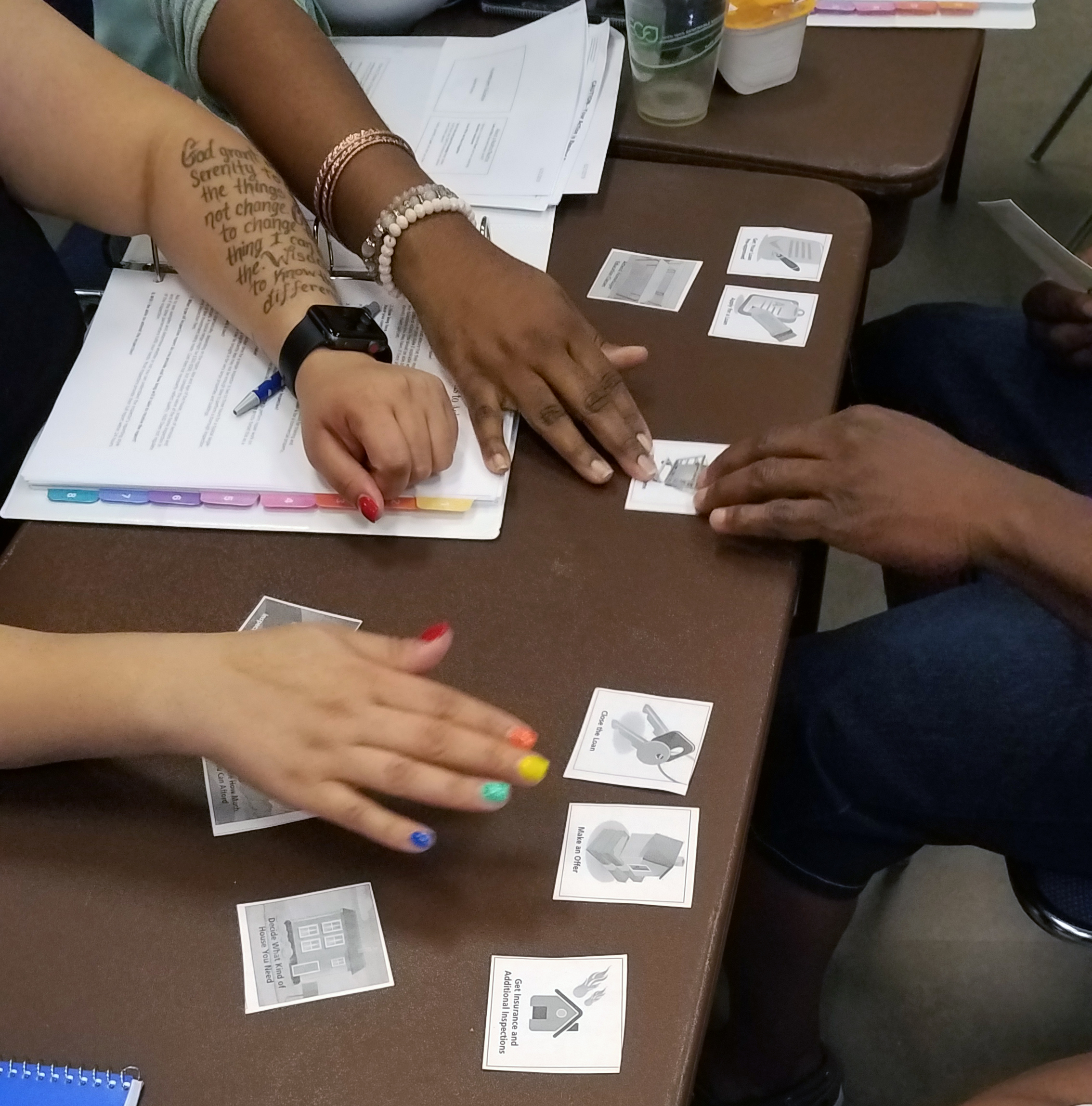

At the monthly homebuyer assistance class, the instruction is as informative as it is practical. It covers a broad range of topics that includes everything from how to improve your credit score, shop for a mortgage, negotiate with a seller and apply for a homestead exemption to the importance of getting pre-qualified with a lender and getting a housing inspection before making a final purchase decision. Hamilton stressed the need to get pre-qualified because these days, houses are selling so fast that people who don’t have pre-approvals often lose out to other buyers who are ready to move forward more quickly.

“When you’re buying a house, you’re doing two things at the same time,” Hamilton told the class. “You’re finding your home – that place where you want to be with your family. But you also need to make a good deal. What I want you to come out of here with today are tools – things that you can use to help you make a good decision.”

At the beginning of the class, the anxiety in the room was evident. Several hands were raised when Hamilton asked how many in the room were far enough along in the home-buying process that they’re already working with a lender or realtor.

“I have someone I trust,” said one of the participants. “But to be honest with you, I don’t know what I’m doing – no clue.”

Hamilton, though, reassured the class that it’s normal to be nervous about such a momentous decision as buying a house.“It’s a complex process and there’s a lot to it,” she said.

Then Hamilton walked the class through the numerous steps in the process, from preparing to apply for a mortgage and shopping for a home to making an offer, getting an appraisal, inspection and insurance, and closing on the loan. Along the way, she sprinkled in lots of practical tips such as how to improve your credit score. That’s important because the better the credit score, the more favorable the terms of a mortgage. So she urged class members to do things such as pay their bills on time and maintain a mix between revolving credit accounts like credit cards and installment accounts like a car loan. She also explained that cancelling a credit card you’re not using usually is a bad idea because one of the things lenders look at is an applicant’s credit limit. And cancelling a card essentially reduces your credit limit, which could result in a lower credit score.

Then Hamilton walked the class through the numerous steps in the process, from preparing to apply for a mortgage and shopping for a home to making an offer, getting an appraisal, inspection and insurance, and closing on the loan. Along the way, she sprinkled in lots of practical tips such as how to improve your credit score. That’s important because the better the credit score, the more favorable the terms of a mortgage. So she urged class members to do things such as pay their bills on time and maintain a mix between revolving credit accounts like credit cards and installment accounts like a car loan. She also explained that cancelling a credit card you’re not using usually is a bad idea because one of the things lenders look at is an applicant’s credit limit. And cancelling a card essentially reduces your credit limit, which could result in a lower credit score.

Participants spent some class time identifying the advantages and disadvantages – yes, there are some disadvantages – of owning a home. For instance, homeowners are responsible for maintenance and upkeep, neighborhood association fees, annual property taxes and insurance and sometimes have to abide by deed restrictions. Also, it’s often harder to move if you have to sell a house first. But the advantages are many – stability, tax incentives, building equity, and the freedom to put your personal touch on a home of your own.

The class also includes a hard dose of fiscal reality. Hamilton devotes a great deal of time to discussing money management and the financial responsibilities of home ownership. And she told the students that they need to have between $2,000 and $3,000 on hand before even starting to look for a house to cover expenses like moving costs, utility deposits, ordering an inspection and appraisal, and putting up a down payment after an offer is accepted.

“You’ve got to have good money management skills to pay your mortgage and manage everything that comes with home ownership,” Hamilton told the group. “You have to make sure you’re living within your means, paying your bills on time and really managing your money. The best way to do that is to create a real budget so you understand how much money you’re spending.”

Another crucial financial reality of home ownership, Hamilton explained to the class, is keeping up with maintenance and repairs and setting aside money for expensive components such as the roof or air conditioning unit that will need replacing over time.

“In order to keep the value of your home, you have to keep it in good repair,” said Hamilton. “And that takes money.”

It’s an important economic message that was reinforced by other speakers in the class, such as Smruti Collins, a mortgage loan advisor with National Lending.

“To buy a house is expensive,” Collins said. “You’ve got to think about more than what neighborhood you want to live in. You’ve got to think about the finances.”

In addition to all the practical tips and helpful advice, the participants earned an extremely valuable commodity – a certificate of completion. By completing the pre-purchase homebuyer class, participants who meet program eligibility guidelines can qualify for financial assistance to help with down payment and closing costs. Volusia County, for instance, has a homebuyer assistance program that offers zero-interest, deferred payment loans to income-eligible homebuyers. To qualify for the county’s program, applicants must be able to secure a first mortgage and can’t have owned a home within the last three years or previously received housing assistance from the county. Financed with state and federal grants to help boost home ownership and make payments more affordable, the county program has been so successful that the Volusia County Council is being asked to move an additional $651,000 of housing money into the homebuyer assistance program. The state also has a homebuyer assistance program, and each program has its own eligibility criteria.

By the end of the day, it was all very welcome information that had the participants sounding a lot more confident when they left the class than when they walked in.

“At first, I was a little intimidated,” said one class participant, Jimmy Lebron. “But they gave you all the tools you need.

As a future homebuyer, this was a necessary education.”

Another participant, Cristina Torres, agreed. “The class was great. I learned a lot.”

**********

The University of Florida/Volusia County Extension is a joint venture between Volusia County, the federal government and the University of Florida’s Institute of Food and Agricultural Sciences that sponsors various community initiatives and offers a wide range of educational opportunities designed to sustain and enhance the quality of life. Housing counseling assistance is among the many services provided by the Extension. The pre-purchase homebuyer class is offered monthly, free of charge, on a first-come, first-served basis at the Volusia County Agricultural Center, 3100 E. New York Ave., DeLand. A bilingual version of the class is offered quarterly. For more information or to register for an upcoming class, call 386-822-5778 or email Patricia Caradonna at pcaradonna@volusia.org.